Irrevocable Living Trust Form Florida

Creating an irrevocable trust is a serious decision.

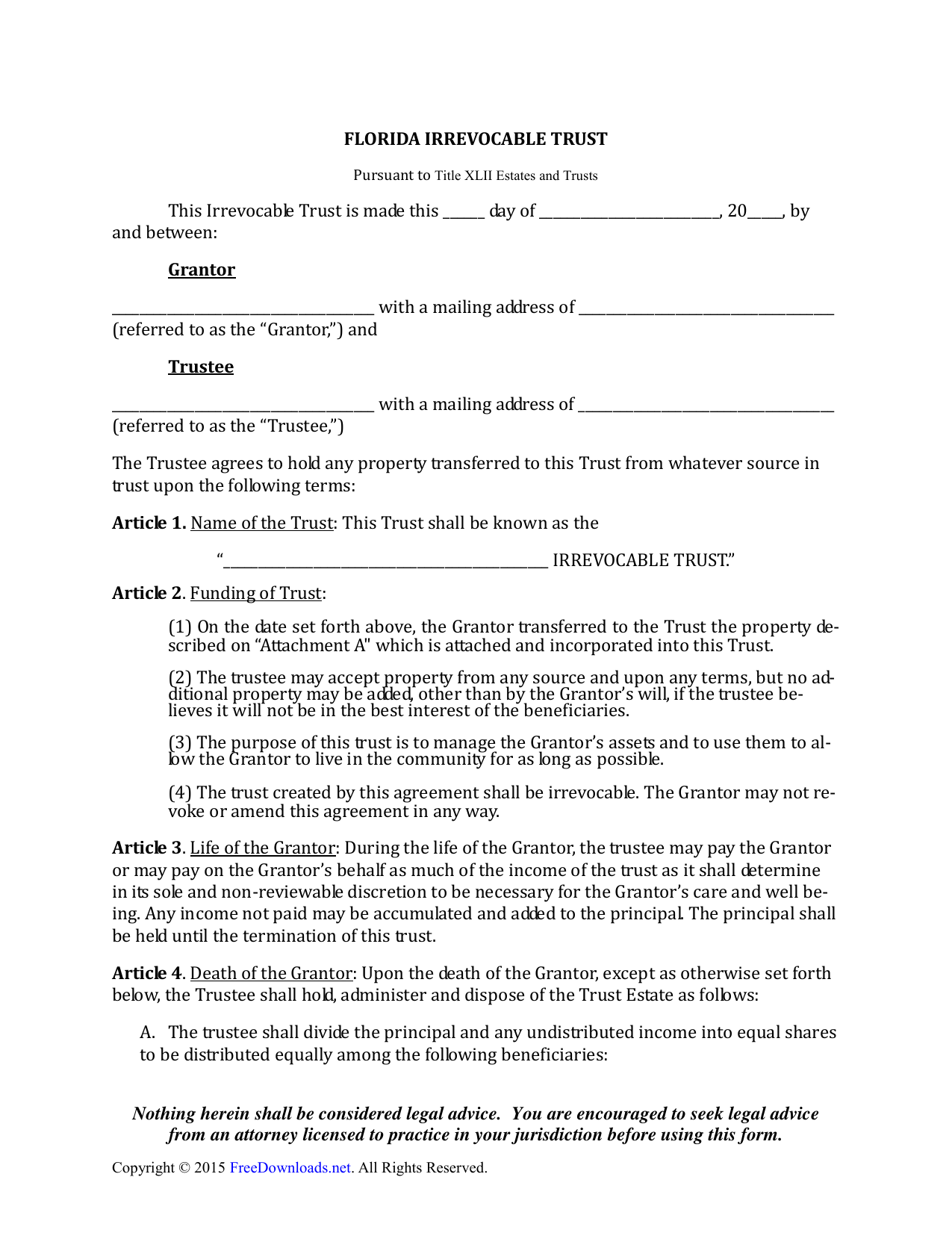

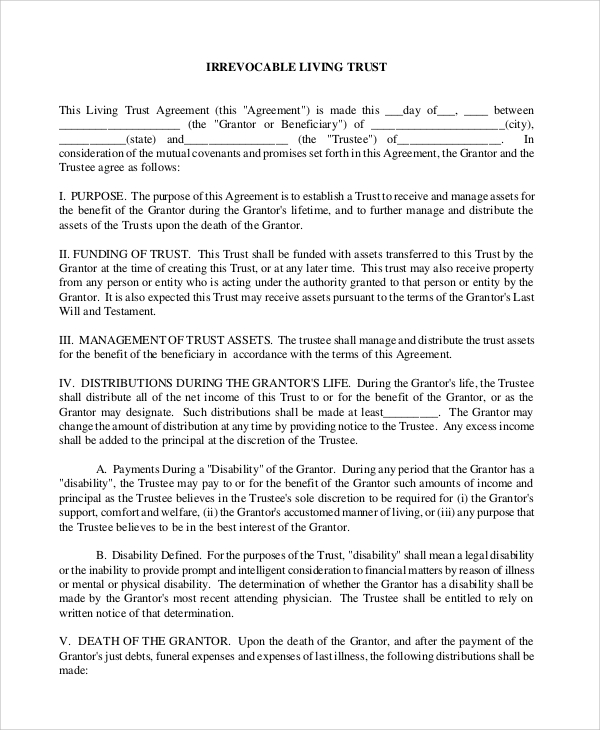

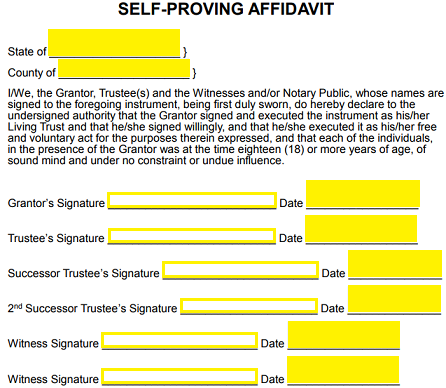

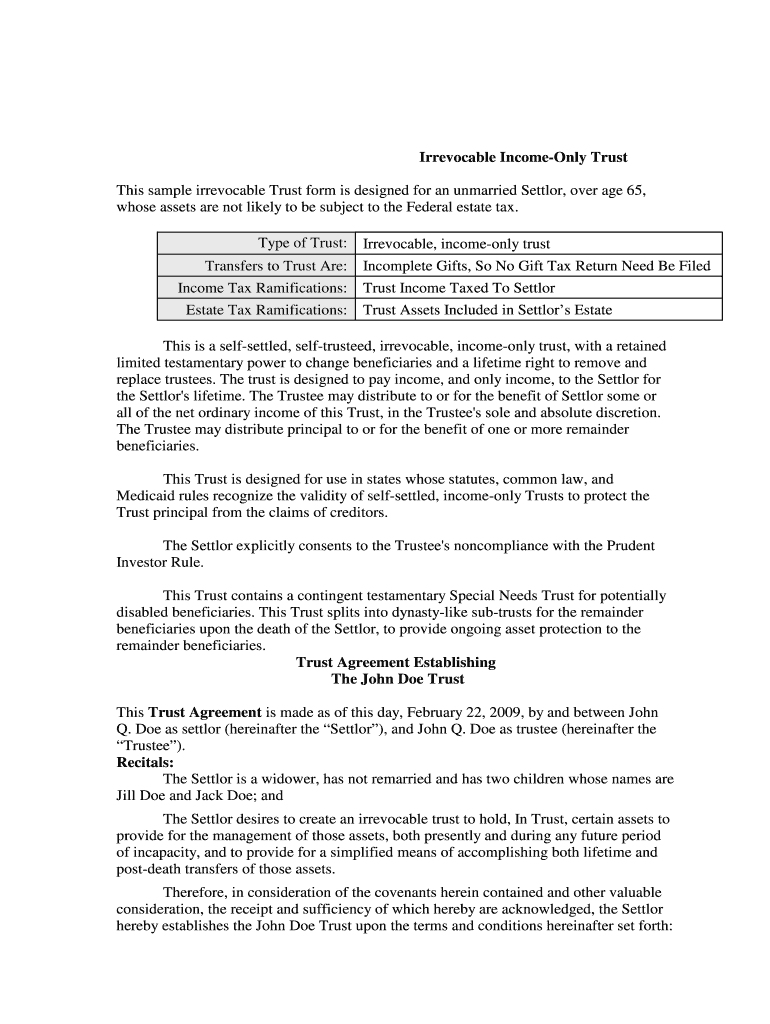

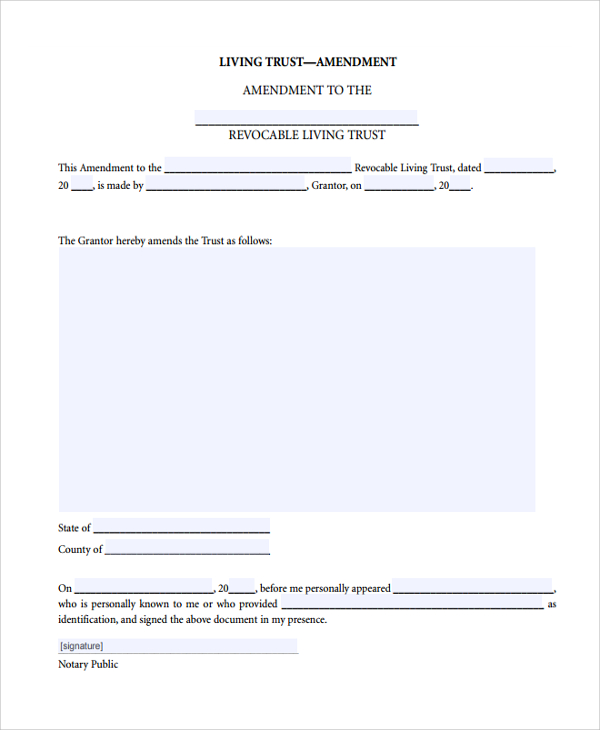

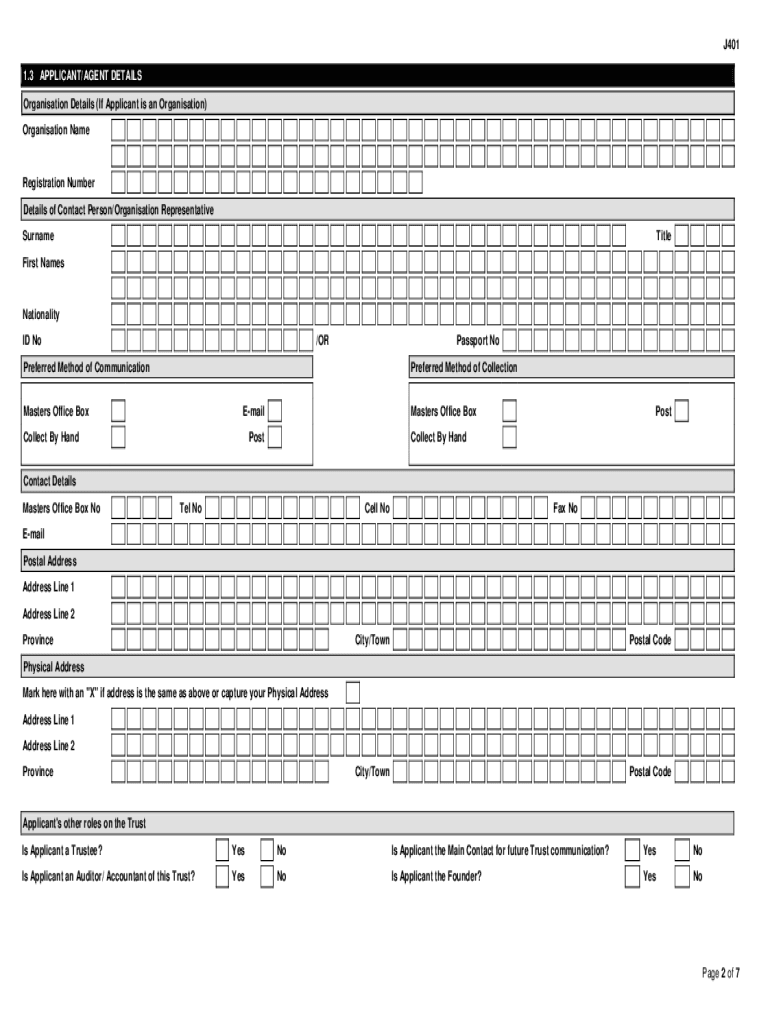

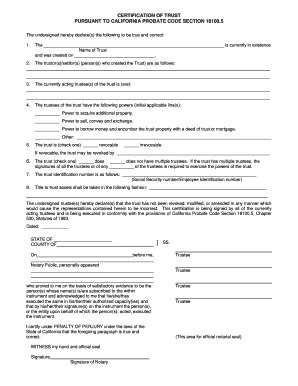

Irrevocable living trust form florida. Florida irrevocable living trust form. You determine who serves as trustee and name the beneficiaries. In florida an irrevocable trust can sometimes be modified through a florida power of appointment incorporated within the declaration of trust or by a court if all beneficiaries agree or circumstances have changed so that the underlying purpose of the trust is being frustrated. Download this florida irrevocable living trust form in order to transfer property and assets into a separate legal entity to be used for the benefit of your chosen beneficiaries.

Living trusts may provide many benefits such as avoiding probate protecting assets from creditors keeping your financial affairs confidential minimizing taxes delay and. Florida irrevocable trust laws are found in chapter 736 florida statutes and in common law and court decisions interpreting trust law. Florida law provides that property held in an. Irrevocable trust asset protection.

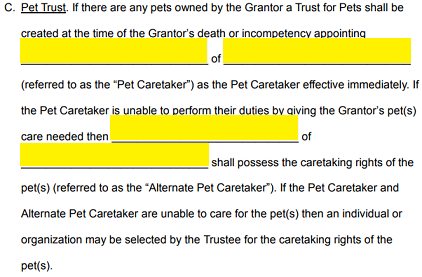

Some types of irrevocable trusts include an irrevocable life insurance trust irrevocable family trust medicaid income trust special needs trust and charitable trust. Florida living trust forms irrevocable revocable a florida living trust allows a person the grantor to legally define the recipient s of their assets after they die. Even though you ll give up control over the trust property you do have control over the rules that govern the trust and you can determine the uses of the trust assets. Download this florida irrevocable living trust form in order to transfer property and assets into a separate legal entity to be used for the benefit of your chosen beneficiaries.

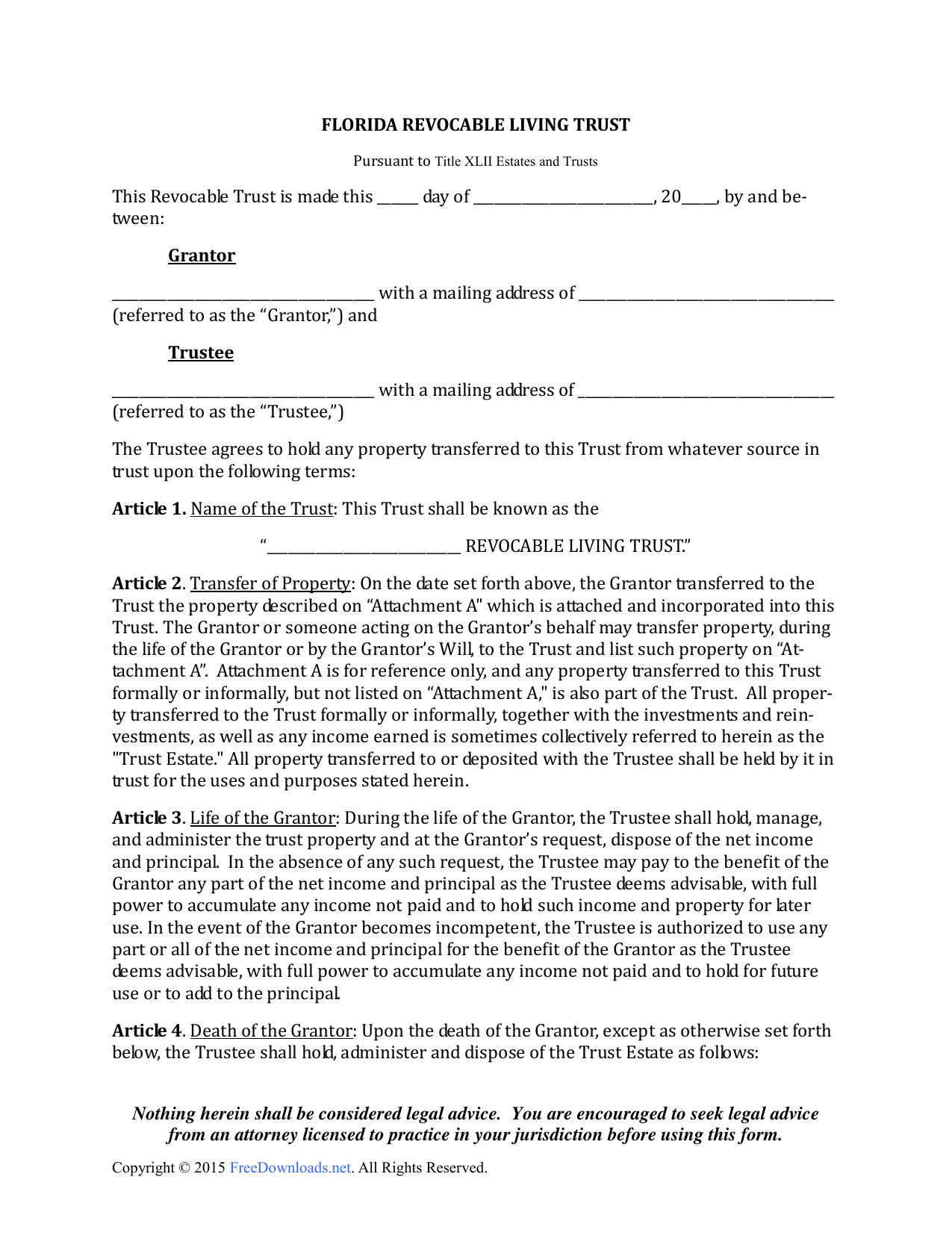

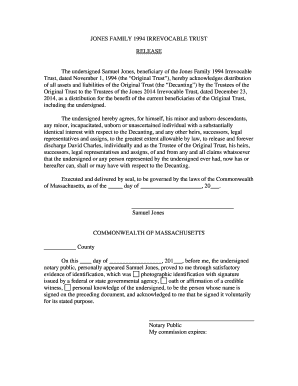

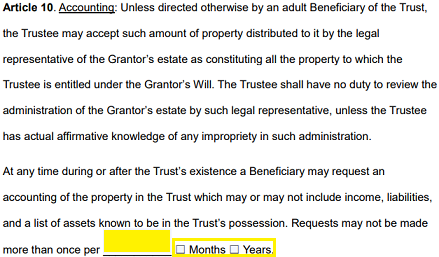

The revocable trust has certain advantages over a traditional will but there are many factors to consider before you decide if a revocable trust is best suited to your overall estate. A trust can provide a grantor with increased flexibility when deciding how and when he or she wants his or her beneficiaries to receive the assets and property. But the grantor cannot do it him or herself on a whim. Thereafter when the youngest living child of a deceased child of the grantor attains age thirty 30 the trustees shall distribute the remainder of the trust for the surviving children to and among said living children in equal shares and their trust shall then terminate.

Understanding irrevocable living trusts. An irrevocable living trust in florida is an irrevocable trust that is made during the lifetime of the trust settlor. State specific trust forms for. Florida revocable living trust form.

The florida revocable living trust is a legal form created by a person a grantor into which assets are placed with instructions on who will benefit from them the grantor appoints a trustee to manage the trust in the event they become mentally incapacitated. The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736 florida statutes.