Irs Business Energy Tax Credit 2018

Use these revised instructions with the 2018 form 5695 rev.

Irs business energy tax credit 2018. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019. In addition your general business credit for the current year may be increased later by the carryback of business credits from later years. Non business energy property credit. New construction and rentals do not apply.

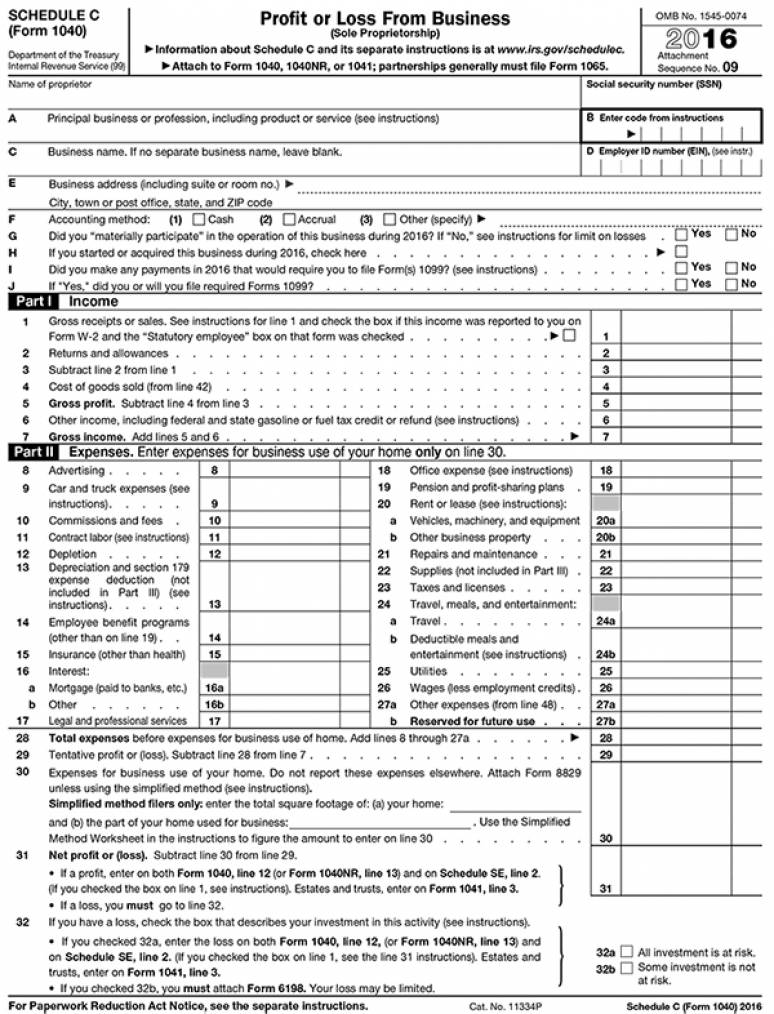

Complete and file irs form 5695 with your tax return to claim either the residential renewable energy tax credit in current and future years or the non business energy property tax credit for prior years remembering that the tax credit no longer applies to years prior to tax year 2018. Small business administration sba. Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The sba offers a variety of federal tax credit irs forms and documents that provide guidance for filing and eligibility. If congress renews the nonbusiness energy property credit for 2018 it would be claimed by completing irs form 5695. You subtract this credit directly from your tax. Your general business credit for the year consists of your carryforward of business credits from prior years plus the total of your current year business credits.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs. Where to look for small business energy tax credits. To claim the credits you must meet all qualifying criteria.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit. Irs tax tip 2017 21 february 28 2017. Safe harbor for taxpayers that develop renewable energy projects 29 may 2020 recent legislation has retroactively impacted the 2018 instructions for form 3468 10 feb 2020 other items you may find useful. The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

This means your home must be your main or primary home and the improvements to energy efficiency must meet specific energy standards. Here are some key facts to know about home energy tax credits. Must be an existing home your principal residence. The residential energy credits are.

These include irs forms for tax credits for. December 31 2020 details. The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021. If you re searching for small business energy tax credits you could start with the u s.