Irs Energy Tax Credit 2017 Windows

Any amounts provided for by subsidized energy financing can t be used to figure the.

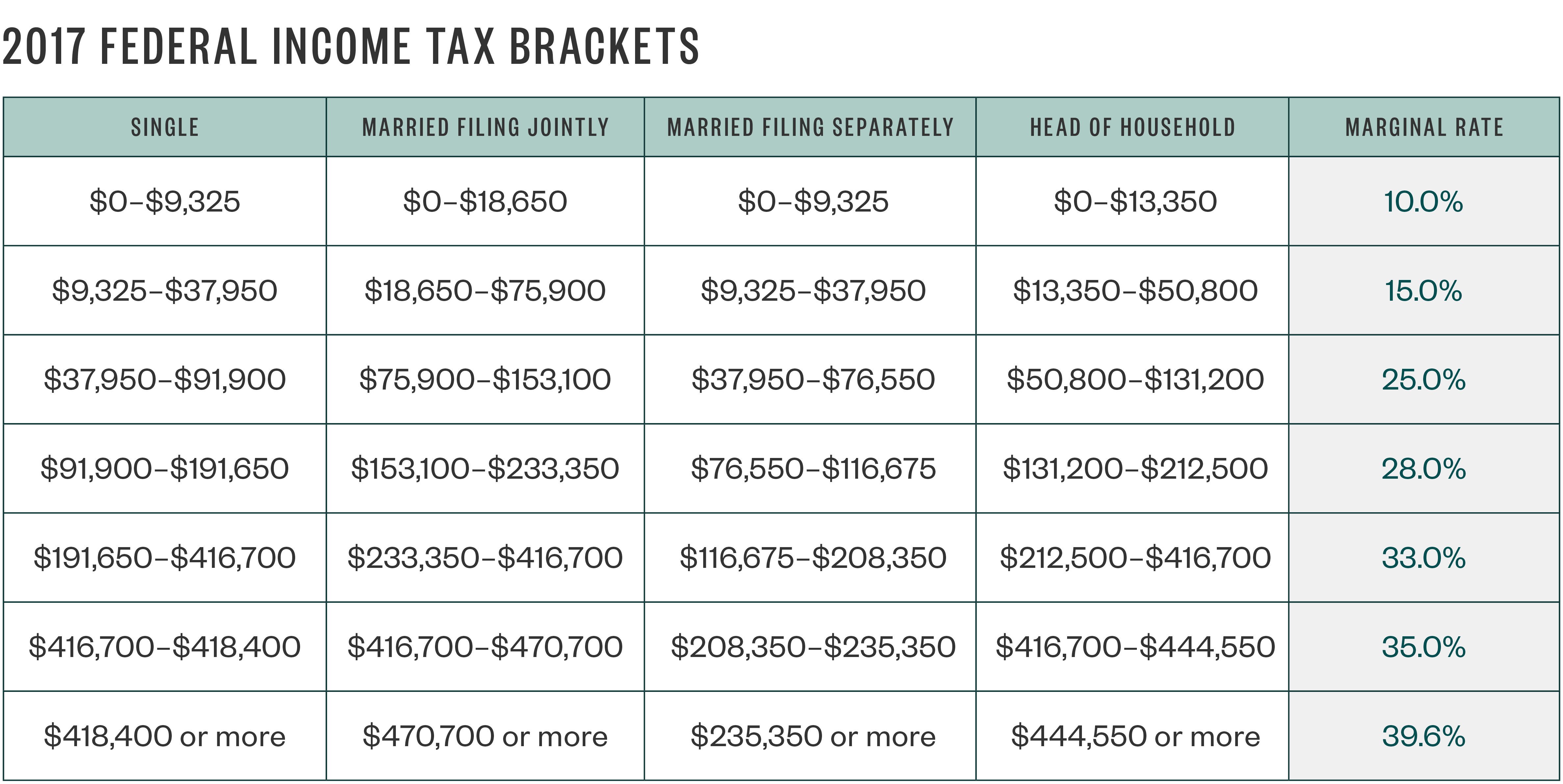

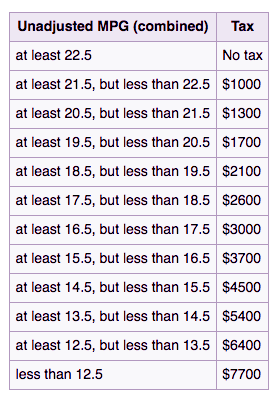

Irs energy tax credit 2017 windows. Here are some key facts to know about home energy tax credits. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. In 2018 and 2019 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows. 10 of cost up to 500 or a specific amount from 50 300.

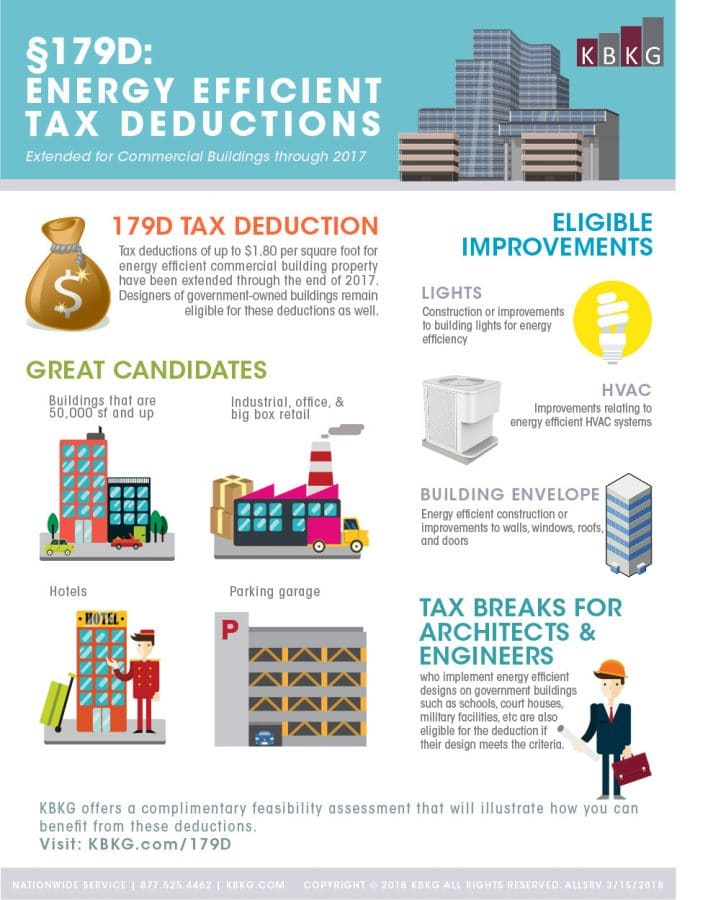

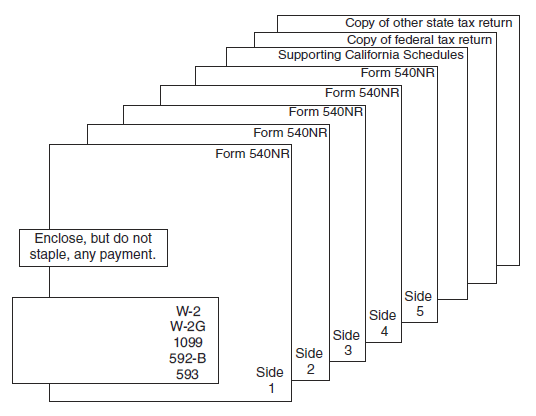

Use these revised instructions with the 2018 form 5695 rev. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

The residential energy credits are. And 300 for any item of energy efficient building property. You may be able to take these credits if you made energy saving improvements to your principal residence during the taxable year. Federal income tax credits and other incentives for energy efficiency.

If the total of any nonbusiness energy property credits you have taken in previous years after 2005 is more than 500 you generally can t take the credit in 2017. These instructions like the 2018 form 5695 rev. Simonton windows doors located at 5020 weston parkway suite 300 cary nc 27513 certifies that certain exterior windows and doors that are energy star qualified for the climate zone in which they are installed may be eligible for the tax credits as set forth in the extension of the american taxpayer relief act of 2013. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

This is a summary of the tax credit elements related to windows and doors as set forth in section 25c of the internal revenue code as modified by the further consolidated appropriations act 2020 which was signed by the president on december 20 2019 which among other things extends the tax credits in section 25c of the internal revenue. Complete and file irs form 5695 with your tax return to claim either the residential renewable energy tax credit in current and future years or the non business energy property tax credit for prior years remembering that the tax credit no longer applies to years prior to tax year 2018.