Irs Energy Tax Credit 2017

/GettyImages-57173091-66f9b5d085fc4aa780d30dc7d2261489.jpg)

Irs tax tip 2017 21 february 28 2017.

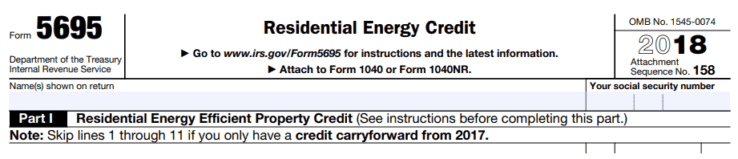

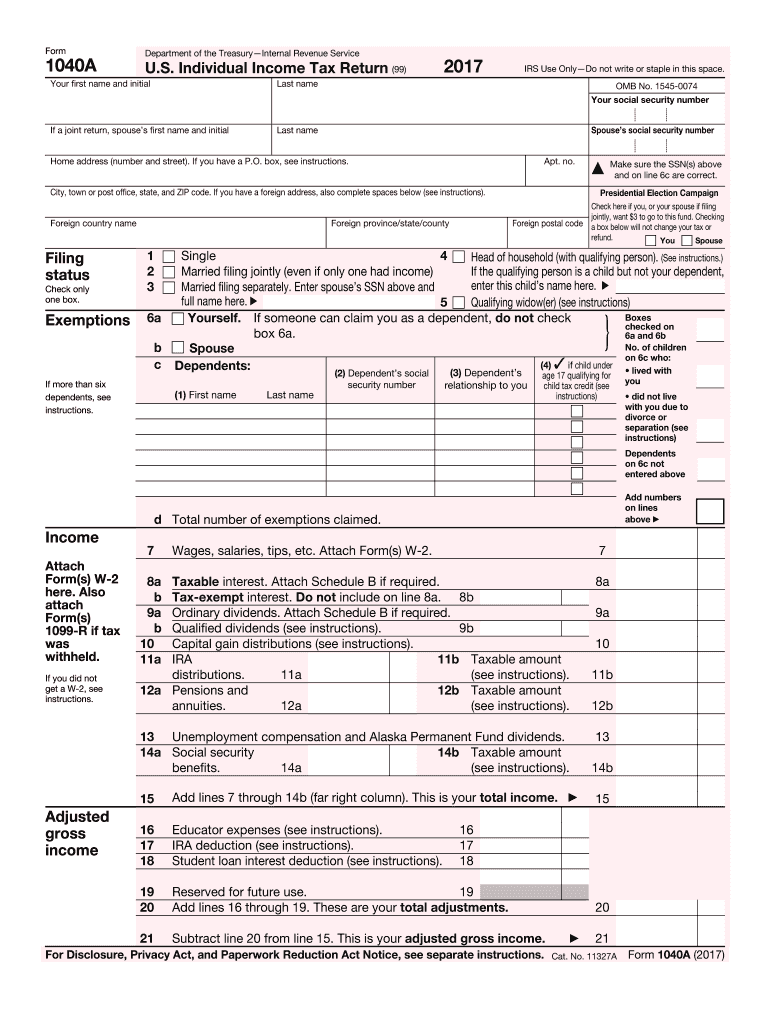

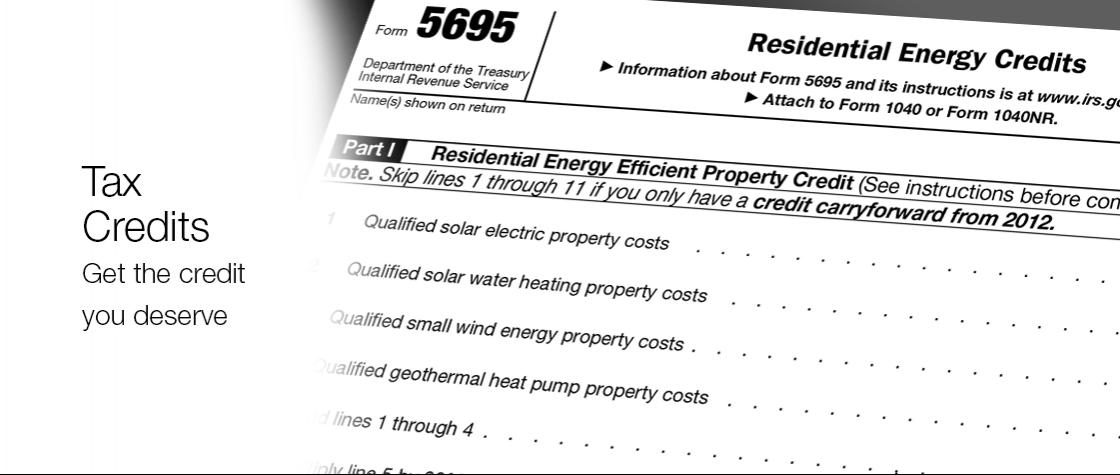

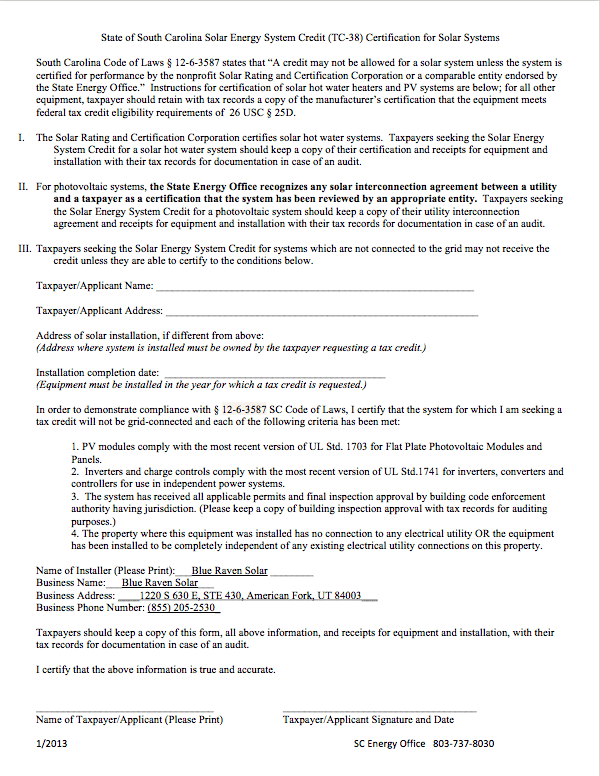

Irs energy tax credit 2017. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Any residential energy property costs paid or incurred in 2017. Internal revenue service residential energy credits. The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020 tax credit.

A total combined credit limit of 500 for all tax years after 2005. Residential energy credits keywords. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. 2017 form 5695 2017 page.

You may be able to take a credit equal to the sum of. Here are some key facts to know about home energy tax credits. However this credit is limited as follows. 2 part ii nonbusiness energy property credit 17.

10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2017 and 2. Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year. Non business energy property credit. A were the qualified energy efficiency improvements or residential energy property costs for your.