Irs Federal Energy Tax Credit 2017

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

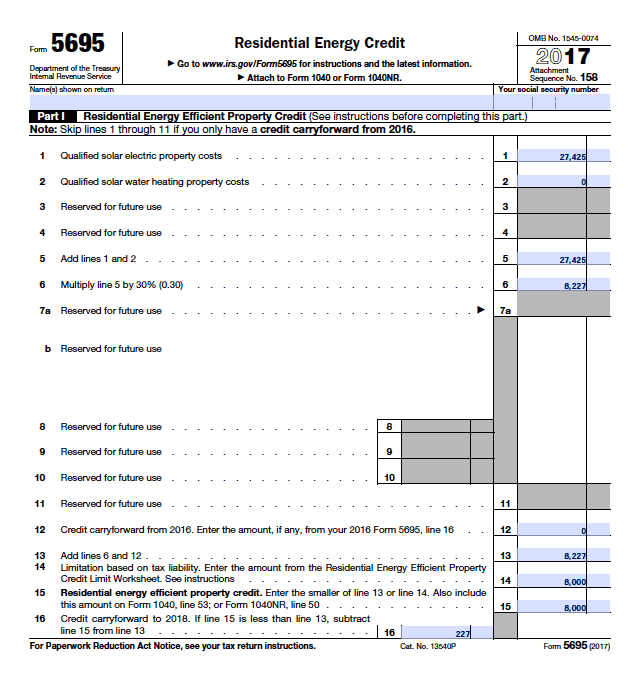

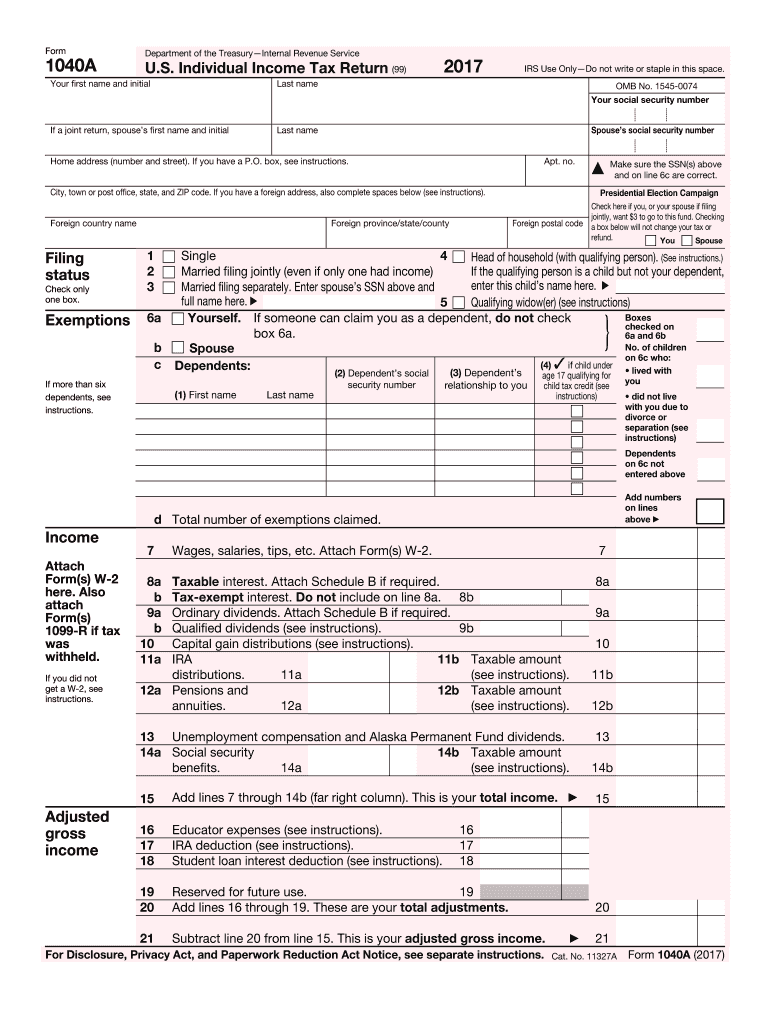

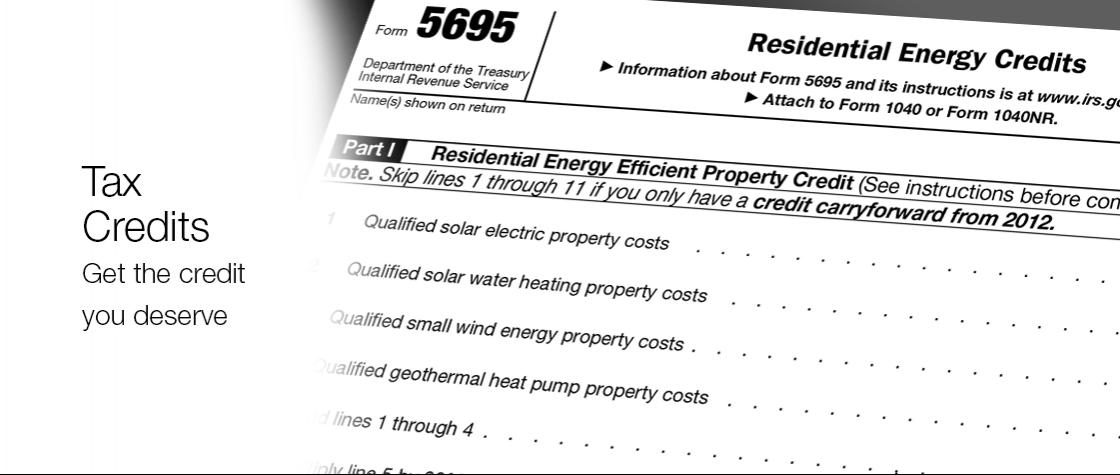

Irs federal energy tax credit 2017. Non business energy property credit. Here s what you need to know when filing for tax years 2019 2020 and 2021. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. 10 of cost up to 500 or a specific amount from 50 300.

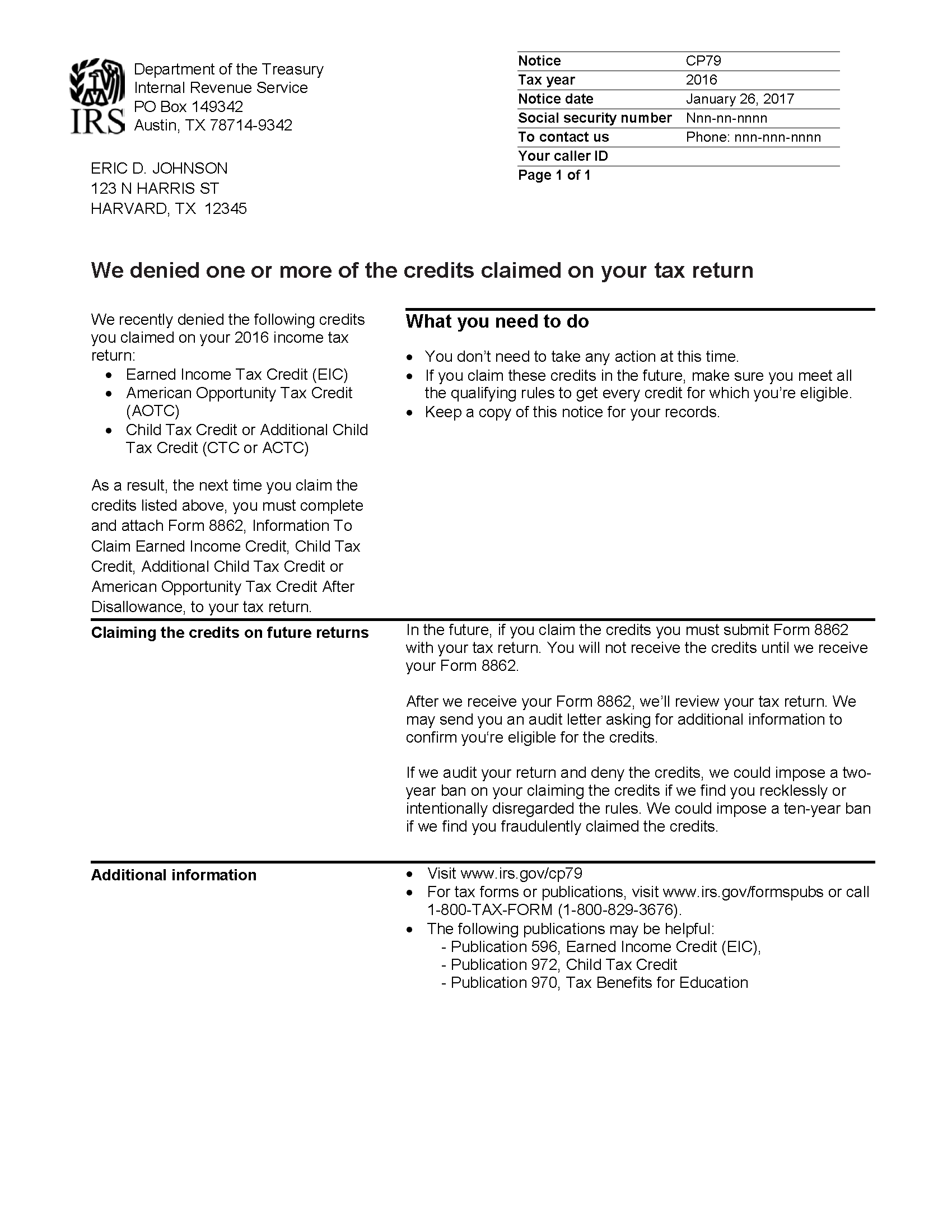

You must have purchased it in or after 2010 and begun driving it in the year in which you claim the credit. Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules. Irs tax tip 2017 21 february 28 2017. Any amounts provided for by subsidized energy financing can t be used to figure the nonbusiness energy property credit.

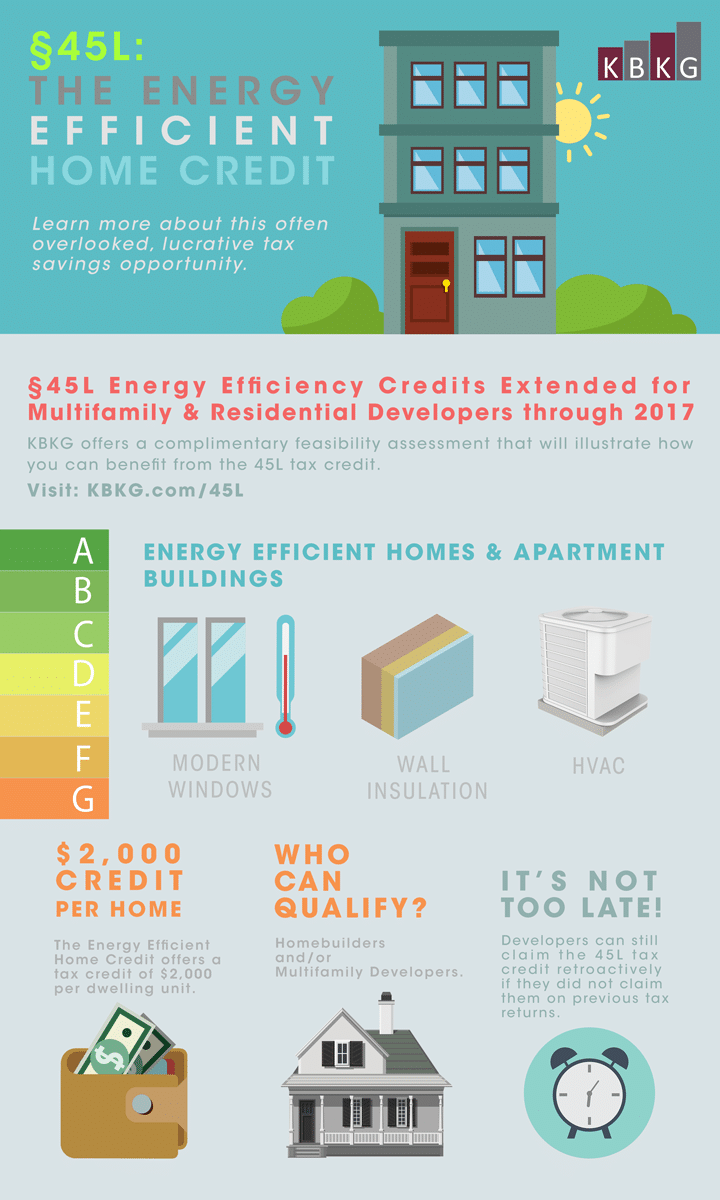

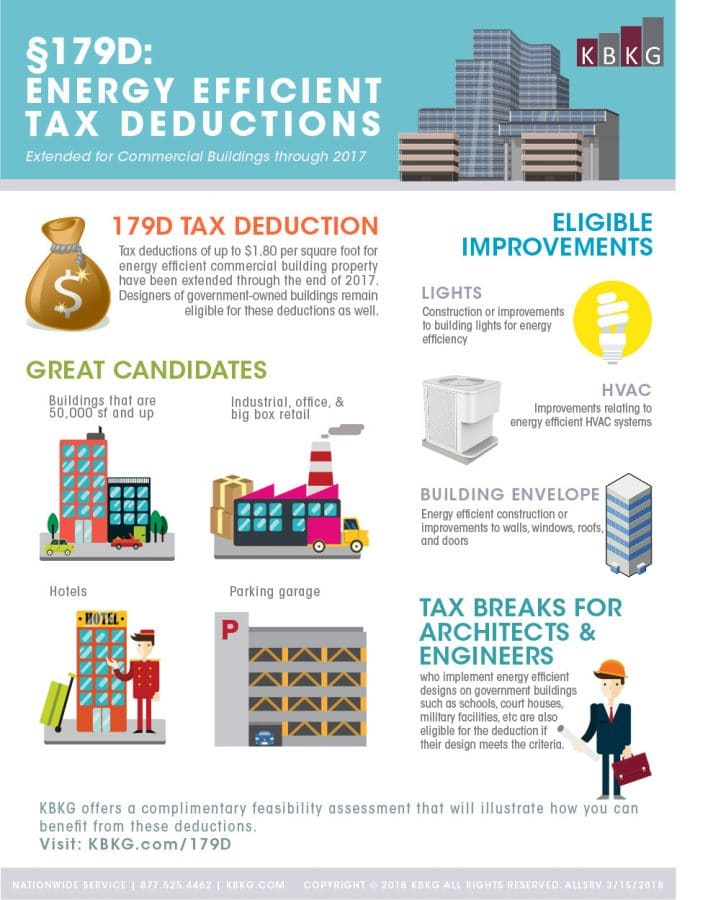

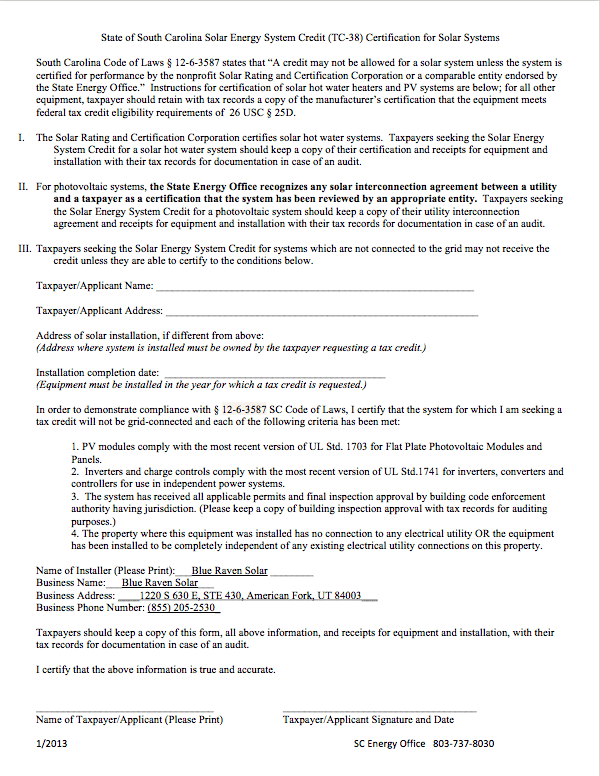

You may be eligible for a credit under section 30d a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14 000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. To claim a general business credit you will first have to get the forms you need to claim your current year business credits. In addition to the credit form in most cases you may also need to file form 3800.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act. The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020 tax credit. If you file a form 1040 or 1040 sr schedule c you may be eligible to claim the earned income tax credit eitc.

The residential energy credits are. If the total of any nonbusiness energy property credits you have taken in previous years after 2005 is more than 500 you generally can t take the credit in 2017. Federal income tax credits and other incentives for energy efficiency. This is financing provided.