Is Vinal Siding Federal Energy Credit

Irs section 25c tax credit for insulation and home sealing products is in effect through december 31 2017.

Is vinal siding federal energy credit. As part of the fiscal cliff compromise congress has reinstated federal energy tax credits for homeowners who improve the efficiency of their homes by installing energystar rated replacement windows. Fill out irs form 5695 to submit with your income taxes. For 2019 the consolidated budget bill passed in december 2019 retroactively extended the energy savings credits for 2018 and 2019. Vinyl siding is not an eligible improvement for the energy tax credit but it may qualify for the sales tax deduction instead.

0 2 586. That includes the non business energy property credits which includes things like windows doors and insulation. Like with new windows they must meet the standards of energy star. Although there are currently no federal energy tax credit programs for 2018 there are many rebates and incentives available through state and local municipalities as well as utility companies.

You can claim 10 of the cost of new doors up to a maximum of 500. Vinyl siding is not eligible for a federal tax deduction. Save the contract and the nfrc labels attached to the product to claim your credit. The new tax credit is 200 for replacement windows and 300 for energy efficient doors with windows and 500 for doors alone.

Again partial replacements are also eligible as are adding new doors that weren t there previously. The tax credit is a reduction from your income tax liability. I installed foam backed insulated vinyl siding on my house in 2015. Details of the tax credit.

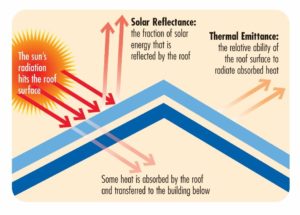

This is known as the residential renewable energy tax credit. You can check your windows and house wrap insulation to see if it meets the standards to be eligible for federal income tax credits for energy efficiency at the following link. Does this quality for an energy tax credit. We installed energy efficient windows vinyl siding and tyvek house wrap.

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency. The united states government offers tax credits to homeowners for energy efficiency in order to reduce homeowners utility bills increase energy independence and to lower pollution. Must be installed in your principal residence between january 1 2011 and december 31 2017. Energy efficient tax credits energy efficiency tax credits are credits that a homeowner can claim on his federal income tax return for home improvements he made that improved the energy efficiency of his home.

Typical bulk insulation products can qualify such as batts rolls and blown in fibers. 10 of the cost not including installation up to 500. Solar wind geothermal and fuel cell technology are all eligible. Most federal energy tax credits for energy saving upgrades for residential homes expired at the end of 2016 while some were retroactively made available to purchases through december 31 2017.