Itc Study Solar Panels

The itc applies to both residential and commercial systems and there is no cap on its value.

Itc study solar panels. The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. Overview the solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance. Economy in the process. As of september 2020 the average solar panel cost in los angeles ca is 2 80 w given a solar panel system size of 5 kilowatts kw an average solar installation in los angeles ca ranges in cost from 11 900 to 16 100 with the average gross price for solar in los angeles ca coming in at 14 000 after accounting for the 26 federal investment tax credit itc and other state and local.

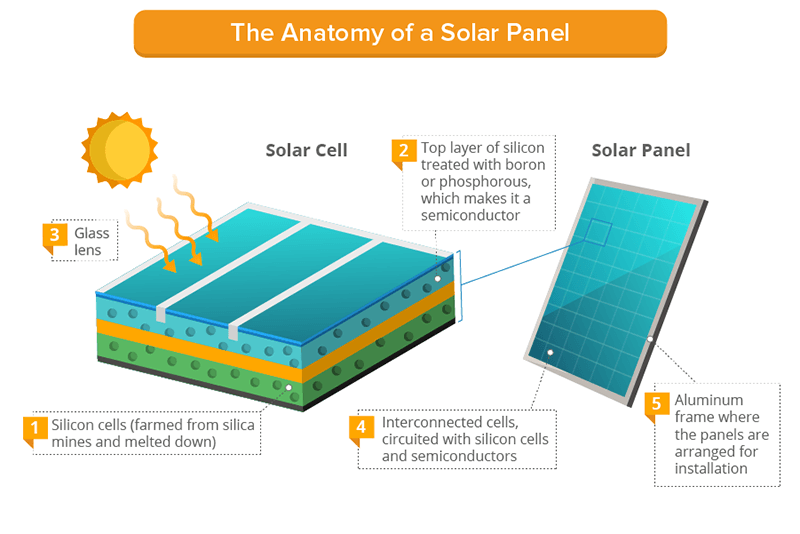

On this page we ll go over the basics of solar energy and explain where to start if you want to buy a solar power system. These two guides one for homeowners and one on the commercial itc provide a concise yet thorough overview of the itc demystifying the tax code with intuitive explanations and examples answering frequently asked questions and explaining the process of claiming the itc. These are the most common questions we hear as we design and sell systems on a daily basis. Bush administration the solar investment tax credit itc was created.

If you re looking for a beginner s guide to solar power you ve come to the right place. Since the itc was enacted in 2006 the u s. The study paid in full. With the passage of the energy policy act of 2005 during the george w.

It allowed people getting a solar energy system installed to recoup 30 percent of the total cost of a solar energy system but residential systems were capped at a 2 000 return. An analysis of the return to the federal taxpayer for internal revenue code section 48 solar energy investment tax credit itc says that tax revenues from solar lease arrangements and power purchase agreements ppas that result from productive solar panels hooked up to the grid can more than repay the cost of the tax credit received for installing the panels. Welcome to solar power 101. Currently the itc is 30 of the gross system cost of your solar project.

The 30 federal investment tax credit itc is among the most important incentives currently available for solar pv. The gross system cost includes any improvements needed to facilitate the installation of a solar system such as electrical work roof work etc.